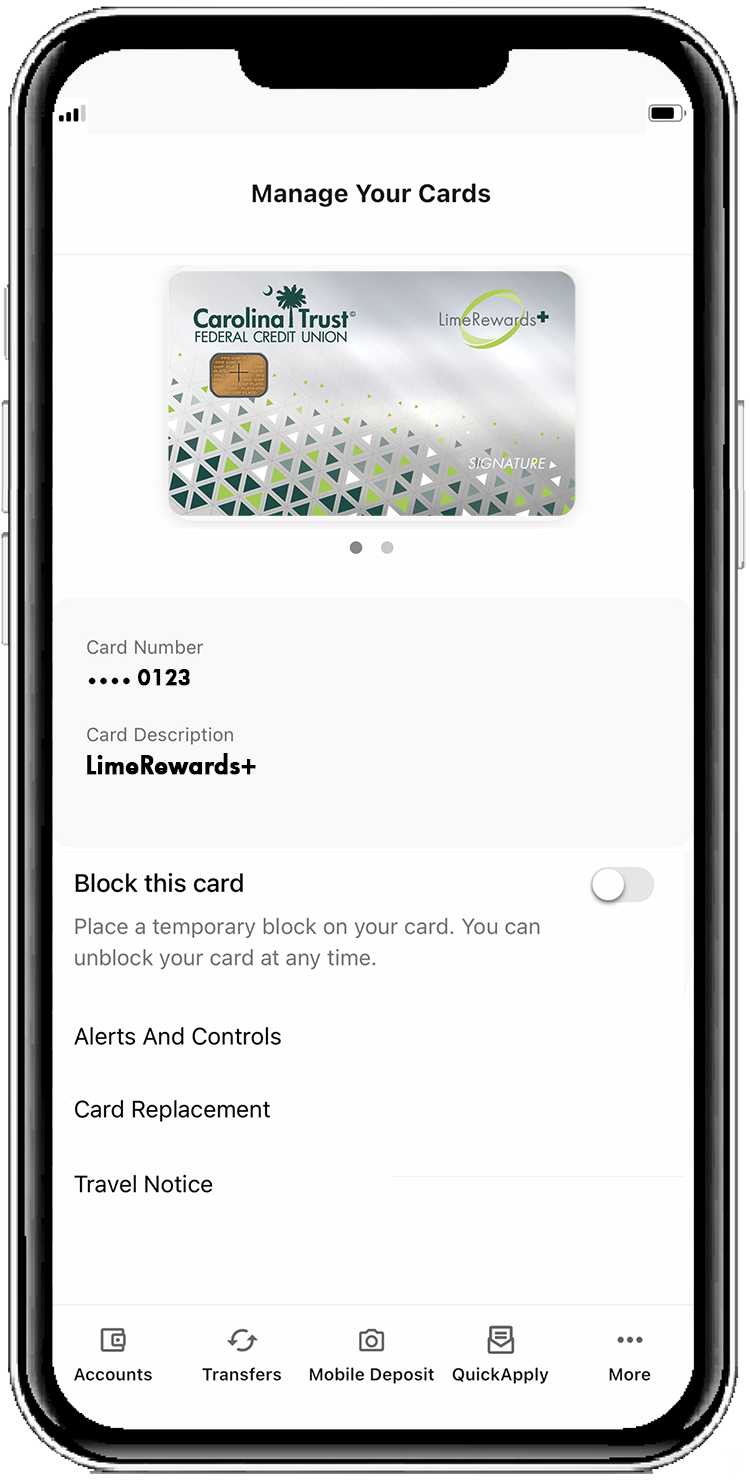

Manage Your Carolina Trust FCU Debit and Credit Cards with Real-Time Alerts

You can conveniently control when, where, and how your Carolina Trust cards are used within the CTFCU mobile app or online. Select between available SMS verified phone numbers and email addresses to receive alerts. Controls are real-time, so you can adjust card controls and proceed with the transaction without a problem.

To explore the different card Alerts & Controls, simply log on to Carolina Trust Digital Banking and navigate to Card Controls, then Card Management.

For shared cardholder accounts:

When a card is shared, each cardholder can set up and receive individual Alert preferences. The only exception is that all cardholders receive alerts for denied transactions. Additionally, any time one cardholder changes a Control setting, the other cardholders receive an alert notifying them of the change.

Alerts & Controls Features:

Allows cardholders to turn a card on or off. When a card is turned off, all transactions made on the card other than recurring payments, credits, and deposits are denied.

Options compare the cardholder’s location and the merchant’s location to decide whether the card can or cannot be used for in-store transactions based on the cardholder’s actual location, region and country.

Allows cardholder to select the kinds of businesses at which transactions are permitted.

Allows the cardholder to control the types of transactions that are permitted.

Compares the cardholder’s location with the merchant’s location to decide whether an in-store transaction should generate an alert based on the cardholder’s actual location, region and country.

Allows cardholders to specify the kinds of businesses at which transactions will generate an alert.

For all transactions, preferred transactions, or no transactions at all.

For preferred transactions, cardholders can specify the kinds of transactions that should generate an alert.

Receive notice or decline a transaction if a specific spending limit, set by the cardholder has been exceeded within a transaction amount or total spent per month

Notify us if your card is lost or stolen that we can quickly process your new card request.

While traveling, provide us with your plans to prevent potential card interruptions.